Challenges for IBM/Lotus Notes Users

In the mid-1990th, Lotus software was the broadest suite of collaborative software. As a result, many enterprises with high demands on collaboration adopted Lotus Notes, especially in highly developed industrial countries. But since then, a lot of requirements have changed and the market has shifted away from IBM.

Collaboration has been opened up from internal collaboration to external collaboration (especially B2B) and to home and tele workers that bring their own devices (BYOD). Now is the era of convergence of communication and collaboration, which means that former collaborative platforms are being enhanced by real time communication such as audio, video and web conferencing. Hardware based telephony systems are being replaced by software solutions with voice over IP (VoIP), so that corporate telephony also becomes part of a collaboration platform choice.

In addition, the inclusion of external members to an organization’s collaboration capabilities have shifted the focus from fat client applications like the Lotus Notes client to web-based frontends and apps for mobile devices.

Microsoft Office integration and ubiquitous, but secure document sharing has become a major productivity requirement, including governance and compliance capabilities as in enterprise content management systems. And last but not least, enterprise search capabilities need to make the different information stores discoverable.

Microsoft has built the leading productivity platform and surpassed IBM and other vendors, because it is better integrated and harmonized. Integration starts with authentication natively in Active Directory and a common base infrastructure for the server operating system, database and systems management, and it continues with functional ease and usability. Many 3rd party applications integrate into the Microsoft platform by default, whereas integration for IBM/Notes does not exist or is delayed. For those customers that do not want to run their own data center, Microsoft provides the same solutions as cloud services within the Office 365 offering. Therefore, Microsoft is seen by Gartner as the most comprehensive productivity cloud provider.[1]

In the last 10 years, many corporations have migrated from Lotus Notes/Domino onto the Microsoft platform. A good overview of the mail platforms of the top 175 enterprises by revenue can be found at: http://dominoorexchange.pbworks.com/w/page/18061910/FrontPage .

Nowadays, Microsoft is leading the corporate messaging and collaboration market. In the messaging area, Microsoft has a market share of more than 85%, according to Gartner. Lotus Notes has dropped below 15%, because Millions of users have been migrated to Outlook/Exchange.

Gartner also recognizes that IBM has lost ground as a Unified Communications (UC) vendor and does not have an offering in the corporate telephony market, whereas Microsoft is seen as a leader both in UC as well as corporate telephony.

Market share of e-mail users in organizations with 500 employees or more, worldwide

In 2011, Gartner already downgraded the rating for IBM in the “MarketScope for Email-Systems” from “Strong Positive” to “Positive” and stated that „We [Gartner] continue to see widespread interest in the Domino base in migrating to alternative platforms.”

The market share drop to less than 15% results in lower support for Notes users when integrating to 3rd party solutions like CRM, ERP, telephony systems and devices. Most 3rd parties deliver Outlook/Exchange integration “out-of-the-box”, whereas support for Lotus Notes does not come at the same time or even needs to be developed by the customers themselves.[1]

IBM also dropped a number of Lotus related products due to shrinking demand and cost pressures:

2005: Lotus Discovery Server (Knowledge Management System)

2005: Lotus Learning Space (E-Learning System)

2007: IBM/Lotus Workplace (Websphere version of Groupware products)

2012: Lotus Symphony (alternative Office suite)

2012: IBM Alloy (Lotus Notes to SAP integration) [2]

2013: Quickr (web-based team application)

2015: Several IBM Sametime server components for web conferencing and telephony. IBM said that customer will rely on Polycom for these components in the future.

2015: IBM’s support for Solaris as operating system for Domino Server

2016: IBM announced that IBM Verse, the new web mail solution, will only be available on a very few, very common server operating platforms in on-premises installations - currently it is not available as on-premises product at all

In 2012, Ginni Rometty, CEO of IBM, announced a shift from core Lotus products to “higher margin products” for the future, underlining that IBM is not trying to turn around the market trend anymore. She said that competing for “legacy” solutions like messaging is not profitable for IBM. In 2015, IBM introduced IBM Verse with a marketing slogan to having re-invented what messaging means. But in fact, Verse is just an updated mail interface to the same Domino backend infrastructure. It has some new features for IBM customers that Microsoft has already in place, most of them for many years like “Mute Threat”, which was mentioned as the highlight by most beta trial customers that took part at IBM’s ConnectEd Conference 2015.[1] But IBM Verse is a browser based interface only – there will be no rich client interface. In addition, IBM provides some newly designed mobile mail apps for iOS and Android which are called “Verse”, which will replace the branding of what was available before as IBM Traveler mail applications. As a new released product, IBM Verse lacks features that former Notes users will miss, like agents that help automate e-mails and full support for all the mobile and offline scenarios.[2]

There is also no API and no programmable URLs for 3rd party solution providers to integrate into Verse. So customers are missing integration with call center and telephony solutions, CRM systems, ERP solutions, fax, room booking systems and so on. IBM said that they will provide programmable URLs for Verse in March 2016, but it will take time until 3rd parties will provide their solutions integrated for Verse, especially when the market share remains low in a saturated messaging market.

The following points are limitations and difficulties in Verse (on the roadmap to be delivered in in March 2016):

- No Offline mode – you have to work online and in IBM’s cloud

- Meeting invitations are difficult

- The calendar does not look consistent

- No support for nested folders when attaching a link to an item in Connections Files

- The default email font can’t be changed

- The screen space is not efficiently used, i.e. the bar on top with photos of contacts can’t be resumed

The following points are ongoing limitations that will not be fixed quickly, at least not in Q1/2016. So please ask your IBM representative when they will be fixed.

- Even if mails can be read offline, it remains unclear what actions can be taken on mails in offline mode. IBM has not communicated details about the offline mode yet despite the fact that the offline mode will be a huge HTML file.

- Attachments can’t be managed in offline mode

- You can’t put multiple people in the “people bubble” in the “important to me” bar

- No seamless contact information with IBM Connections Cloud

- There is no view/filter for unread messages only. You always have to work yourself through all messages.

- The user settings for the interface can’t be retained

- No calendar alarms/alerts

- The messaging pane can’t be resized

- There is no messaging list density control

- Presence/awareness and chat features are very limited

- No administrative assistant access to calendar

- The inbox is not very actionable

- Concerning mobile apps, Verse will only be available for iOS and Android, not for Blackberry and not for Windows Phone. So customers have less choice than they used to have in the past.

- Verse is currently not available for installation in your on data center (on-premises). IBM has delayed an on-premise version to at least end of 2016. But even worse, IBM has not even announced on which server platforms Verse will run. They did announce though that it will only be on a very few server operating systems, probably just on one or two ones. So IBM is limiting the choice for customers, even though they long claimed broad support for multiple operating systems a competitive advantage. On top of that fact, customers will have to install additional components besides Domino server to enable the analytics features. You will probably have to install DB2 besides Domino at least, but that is also left completely unanswered by IBM as of today.

So despite the marketing hype that IBM tries to generate around Verse, there are currently still almost no customers using it – please ask IBM to talk to a reference customer before you sign-up for Verse. Even IBM themselves have just only started the internal rollout to not more than 25% of their employees yet, as they said in February 2016 at IBM Connect 2016 – almost one year after Verse was generally available. So, even at IBM internally 75% of the employees do not use Verse because of the limitations mentioned above. Instead, they keep using the old Notes client.

Due to the limitations that Verse has, the beta trial customers on stage at the IBM ConnectEd Conference 2015 such as Mitch Cohen from Colgate clearly stated that “Verse is not for every user in the organization”. So, the question for customer to ask themselves is: are we going to roll out Verse just to some users and use another messaging system for the rest of the users? And what does that mean for the total cost of ownership to maintain and support multiple messaging systems?

But the challenges for IBM and its user base go beyond messaging. Nowadays, customers are looking for a productivity platform that also includes

- Real time communications / unified communications up to voice/telephony

- Document sharing

- Enterprise content management

- Search

- Social software capabilities

But in most of these areas, IBM has lost ground to other competitors, especially to Microsoft, which is reflected by analysts (more details in the Gartner Magic Quadrant sections at the end of this document).

And all of the capabilities are increasingly consumed as cloud services in order to increase agility and innovation and reduce costs. Whereas Microsoft is seen as one of the hyper scale productivity cloud vendors with its Office 365 offering, IBM SmartCloud for Social Business (multitenant) is based on a small scale pod architecture, based on the Softlayer acquisition. That is why Gartner’s Matt Cain states that “IBM is a distant third” compared to Microsoft and Google and IBM’s offering “feels like an SMB [Small and Medium Business] offering”. He states that the sales and support structures are also not on the same level like Microsoft’s in the cloud.[1] IBM has very few and only very tiny reference customers for their multitenant productivity cloud. In fact, the bigger references that IBM has claimed in the past have never deployed IBM’s productivity cloud, the biggest failure in delivery was Panasonic.[2]

Benefits of Moving from IBM to Microsoft

The growing market share for Microsoft results in several advantages versus IBM:

• No risk due to broad market and vendor support, whereas IBM’s partner landscape is shrinking

• Broader choice of 3rd party components (i.e. security plug-ins, mobile device support)

• High interoperability with partners in B2B scenarios, for example free/busy lookup and awareness across organizations or B2B encryption within Exchange

• Availability of service providers for hosting[1], development and support

• Availability of Microsoft experts

• Fidelity of documentation of the products, adoption of new standards, provisioning of technical events

For business units, there are also advantages such as:

• Attracting and retaining talents as an employer with a modern workplace environment

• Better usability, for example due to

• Transparent mobile „anywhere access“

• Single Sign-On

• Autodiscovery feature

• Performant clients

• Less glitches and bugs in the software products

• Less trainings needed in the long run, also in merger & acquisition scenarios (Home Use Program and online trainings included in the license contract)

• Consistent user interface and seemless integration of Office products (less overlaps and media breaks)

• Higher degree of self-services without IT involvement

• Easier integration with externals (B2B collaboration)

• Calendar and presence federation

• Conferencing internally and externally on the same platform (Lync)

• Administrative B2B encryption between two different Exchange organizations without the need for the user to encrypt mails

• Performant fulltext search on the client as well as across systems (SharePoint)

• Integrated compliance and reporting solutions

• Better protection of intellectual property with rights management

In addition, there are economic benefits that customers reported when migrating from IBM to the Microsoft platform, such as:

• Focus on Microsoft and SAP as strategic vendors saves costs. Festo, Heraeus, TÜV Rheinland, Bayer and others reported less dependencies, test effort at upgrades and client patches

• Infrastructure: Reduction of complexity

• Avoiding extensions of the infrastructure to J2EE, Websphere, Connections, FileNet, Content Analytics etc.

• Dropping maintenance of Notes client and Domino directory

• Less 3rd party add-ons (i.e. mobile synch software, security plug-ins)

• Less need for VPN (RPC access over HTTPS, Direct Access). Accenture drove a “self financing migration” with 80% less VPN-related helpdesk calls than before.

• Automization of administrative processes via Powershell skripts with efficiency gains of up to 30%.

• Possibility to run Exchange without classic backups, just by Exchange board mechanisms. This saves costs and allows for faster and less faults when restoring information

• Consolidation of Notes applications

• Server und data center consolidation. Bayer consolidated from 50 Domino data center locations, 1200 Domino servers, 8 Sametime data center locations to a Microsoft infrastructure with 3 data center locations for SharePoint and Lync and 2 Exchange locations

• Lower performance requirements (IOPS) reduce storage costs. Deutsche Bank and Allianz both switched from SAN (Storage Area Networks) to DAS (Direct Attached Storage) with the messaging migration and saved 18,000 €/TB and year; a sum of 2 Million € per year.

• Thin client strategy at reduced costs: less RAM resource consumption by Outlook results in 30% lower performance requirements for the terminal server farm compared to running Domino.

• By replacing telephony solutions and external conferencing services with Lync, customers can reduce housing costs, carrier costs, PBX maintenance and electricity costs in addition to spending less on telephony devices. For example, when replacing 489 PBX, Sprint reports total costs of yearly savings of 13 Million €[2], of which housing costs reduced by 2.4M€ (150,000 qm x 16€), local carrier costs reduced by 5.1 M€, maintenance reduced by 1.9 M€, audio conferencing costs reduced by 3.1 M€, electricity savings of 0.5 M€. In addition, they also calculated massive cost savings due to the broader choice of devices (70% of the costs of a classical hardware based PBX are devices).

• Attractive license bundles by Microsoft (Core-CAL, E-CAL suite, cloud suites)

The cost benefits of up to 35% after a migration from IBM/Notes to the Microsoft platform have also been reviewed by analysis, such as IDC. [3]

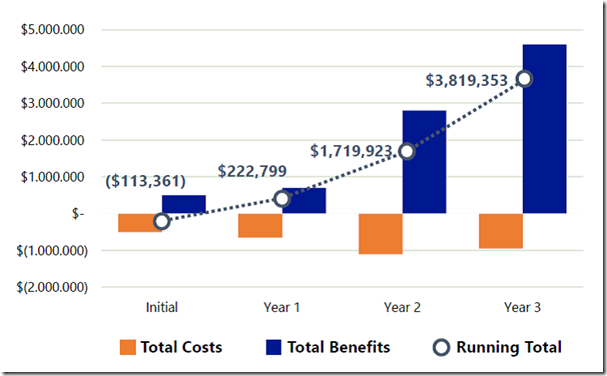

The following shows a typical business case for an IBM/Notes customer that compared 2 scenarios, either to stay on IBM/Notes with additional products or to move to the Microsoft platform. Both scenarios were on-premises and the customer was in negotiations with the same provider, because that provider had a long-running outsourcing contract.

In the Microsoft scenario, the customer wanted to move off of Notes/Domino completely, including all their applications, within 18 months. The brown bars in year 1 and year 2 in the Microsoft scenario display the fixed price cost associated with this full application migration approach.

The cost comparison shows 40% savings in the long run (1.2M€ in the Microsoft scenario versus 2M€ in the IBM scenario from year 3 on) and 19% internal rate of return (IRR). And the case did not even include all potential savings such as moving from SAN to direct attached storage (DAS).

Recently, Forrester has conducted a study about the benefits of moving to Microsoft Office 365. In this study, they have also had interviews with several customers that came from other collaboration platforms such as IBM’s before, but the focus of the study were the savings due to the move to the Microsoft cloud.[1]

For a composite 6000 user corporation, the highlighted results of the Forrester study are:

• Server infrastructure costs replaced (benefits of $2.42M)

• Hardware, software, housing

• Implementation and maintenance, esp. upgrades are included!

• Storage included

• Users delighted of large mail boxes (50GB), without the need to constantly clean up the mailbox in order to stay below the current quota

• Unlimited mail archives

• Unlimited personal shares for document that can also easily shared with externals

• Network

• Use of the Microsoft network with local break-in/out points worldwide è low latency

• New scenarios enabled, i.e. corporate video channel

• In the future: telephony provided

• „Mobility“ (benefits of $2.81M)

• Bring your own device (BYOD) enabled

• Remote/home client installation and work from anywhere

• Office space reduced

• User based licensing

• Control and Compliance ($90k)

• Less time for eDiscovery searches (-10.7%)

• Less data breaches (-73%)

• Enterprise Social Solution with Yammer ($247k)

• More engaged workforce

Due to these cost savings and functional enhancements, many organizations directly move from IBM/Notes to Microsoft Office 365:

| Customer | Industry | Number of Users |

| . | Chemistry | 112000 |

| . | Public Welfare | 48000 |

| . | Consumer Goods | 45000 |

| . | Manufacturing (trains) | 27000 |

| . | Retail | 7500 |

| . | Retail | 6000 |

| . | Medical Goods | 6000 |

| . | Media | 2000 |

| . | Electronics | 130000 |

| . | Chemistry (tires) | 112000 |

| . | Telecommunication | 130000 |

| . | Manufacturing (lifts) | 50000 |

| . | Chocolate | 15000 |

| . | Manufacturing | 140000 |

| . | Logistics | 40000 |

The following chapters describe several areas in productivity suites in more detail, supported by the latest Gartner Magic Quadrants.

Unified Communications

Whereas Microsoft Lync continues to make significant gains in the market and is attractive to a broad range of enterprises, IBM's UC deployments, especially those involving telephony, remain limited[1] [2]. If IBM customers have Sametime deployed for internal presence and IM/chat, they usually have additional other solutions for external conferences such as Cisco Webex or Adobe Connect. This creates additional hurdles for the users, because they can’t easily switch from one solution to another when an external member needs to be added to a conference. It also results in additional IT costs for maintaining dual solutions.

There are also differences between Sametime and Lync in slide sharing fidelity such as pixel resolution and performance.

Corporate Telephony

The biggest difference between Sametime and Lync is that Lync can be used as a stand-alone telephony system, whereas Sametime can only integrate with some telephony systems but not replace them. As a consequence, the current Gartner Magic Quadrant for Corporate Telephony 2015 does not even mention IBM as a vendor, but places Microsoft with its Skype for Business solutions in the challenger sector, on the line to the Leader Quadrant.[1]

In the 2014 report, Gartner stated that „Microsoft is the seventh-largest corporate telephony vendor with 5.1% of the global market in 2013 with significant annual growth of 106% in 2013. Microsoft continues its strong growth in 2014 and is being chosen by more enterprises as their strategic corporate telephony platform.” One year later, in the 2015 report, Microsoft already appears as fifth-largest corporate telephony vendor.

Microsoft has even bigger references in terms of users than Cisco, as Gartner recognizes in the 2014 report. “The architecture for Lync is highly scalable, with references of 200,000 users. Microsoft has a strategy of delivering software-only solutions and creating an ecosystem of partners to provide solutions such as desktop phones, media gateways, session border controllers (SBCs) and paging systems. The all-software strategy enables Microsoft to deliver a market-leading UC platform with strong messaging, conferencing, presence, telephony and mobile functionality.”

According to Gartner, one key differentiator is also the support for different mobile devices, including non-Microsoft platforms: “The Lync 2013 mobile client works on Microsoft, Apple and Android operating systems and is a strong solution for those enterprises seeking a UC and telephony client for their mobile devices.”

Social Software in the Workplace

In the past, SharePoint has been positioned as the core social product from Microsoft. Since 2013, Microsoft announced that it will rather focus on providing integrated user experiences across different products such as Dynamics CRM, Lync/Skype and on-premises SharePoint Server, which will be based on Yammer and Office 365, especially the Office Graph. Microsoft also introduced a first application on top of Office Graph, called Delve.

Gartner recognized this strategy and positioned Microsoft as the top company in the Gartner Magic Quadrant for Social Software in the Workplace[1].

[1] See Gartner Magic Quadrant for Social Software in the Workplace, by Nikos Drakos, Jeffrey Mann, Mike Gotta, September 3, 2014 at: http://www.gartner.com/technology/reprints.do?id=1-20TBOV4&ct=140903 and Gartner Magic Quadrant for Social Software in the Workplace, 2015, http://microsoft-news.com/microsoft-recognized-as-a-leader-in-the-2015-magic-quadrant-for-social-software-in-the-workplace/

[1] See Gartner Magic Quadrant for Corporate Telephony, 2015, at http://www.gartner.com/document/3145119 (Gartner login required) and Gartner Magic Quadrant for Corporate Telephony, by Sorell Slaymaker and Steve Blood, October 21, 2014 at: http://www.gartner.com/technology/reprints.do?id=1-23HXCI1&ct=141022&st=sb

[1] See Gartner Magic Quadrant for Unified Communications, by Bern Elliot, Steve Blood, August 4, 2014 at: http://www.gartner.com/technology/reprints.do?id=1-1YWQWK0&ct=140806&st=sb

[2] See Forrester Wave: On-Premises Unified Communications And Collaboration, Q2 ’14, at: http://www.forrester.com/pimages/rws/reprints/document/85963/oid/1-RJLYLF

[1] See: Forrester, “The Total Economic Impact of Office 365”, October 2014. The study is available through Microsoft. It shows an average ROI of 7 months by moving to Office 365 and a net present value of 5.6M$ over 3 years for a composite company with 6000 users.

[1] There are also a number of productivity cloud providers that offer similar options to Microsoft’s Office 365 out of their data center, for example T-Systems, Atos, CSC and HP.

[2] See: http://www.microsoft.com/casestudies/Case_Study_Detail.aspx?CaseStudyID=4000011522

[3] See: IDC, “Strategic Elements of a Migration to the Microsoft Communications & Collaboration Platform”, Februar 2010. http://www.techfiles.de/presse/pressemappen/Compete/IDC_MS_WP_Collab_Platform.pdf

[1] All of these statements were made in a session by Matt Cain at Gartner’s CIO symposium in Barcelona, November 2014.

[2] Here is the press statement that IBM released on Panasonic: http://www-03.ibm.com/press/us/en/pressrelease/29189.wss. And here is an article that was launched at Heise: http://www.heise.de/ix/meldung/IBM-gewinnt-Panasonic-als-Kunden-fuer-die-LotusLive-Cloud-Services-904536.html . None of the 380,000 Panasonic employees is using IBM’s multitenant cloud mail service today, even though it was IBM’s biggest customer announcement ever.

[1] Such features are: “Mute Threat” and “actionable e-mails”, which are available in Exchange since more than 6 years. In addition, Verse includes machine learning technologies in order to filter what is important to a user so that information is prioritized. Within the Microsoft platform, this was also already available with Office Graph, Delve and Clutter, all of which are tightly integrated in Microsoft Outlook and Exchange.

[2] Currently, IBM Verse does not support apps for Windows Phone and Blackberry, for example.

[1] A remarkable example for that is native support for Apple’s iPhone, which only came to market for Notes with iPhone 3 in January 2010, whereas it was available for Exchange from day 1.See: http://www-03.ibm.com/press/us/en/pressrelease/27493.wss

Other examples are Salesforce.com integration with Outlook in the CRM space, see

[2] See www.Duet.com for the SAP + Microsoft partnership. In comparison, the discontinued IBM product “Alloy” http://www-01.ibm.com/software/lotus/products/alloy/

[1] See Gartner “Cloud Suites for Collaboration: Assessing Microsoft Office 365, Google Apps and IBM SmartCloud for Social Business”, 2013

Your article provided a fresh perspective and encouraged me to learn more. Dive into Brain Age Test and take charge of your cognitive well-being with this insightful test!

ReplyDelete